salt tax deduction repeal

As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers.

. The entity which is not subject to the SALT cap may claim a federal Section 164 business expense deduction and shareholders. Such a plan would be still be very costly and regressive. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts.

Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. The change may be significant for filers who itemize deductions in high-tax states and currently can. Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it.

Get Your Max Refund Today. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut from the revised. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. A group of moderate lawmakers are pushing to repeal the so-called SALT deduction cap in the reconciliation package saying no SALT no deal but other Democrats are trying to slam the brakes on. In states that have PTET legislation a pass-through entity elects to pay state-level taxes at the entity level rather than passing on the full tax liability to individual owners with state tax credit to individual owners for state taxes paid by the entity.

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. Pulling the SALT fix out of the legislation also will make it tougher to pass the legislation through the House where last week three Democrats from New York and New Jersey insisted they wont. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. As adopted under the Tax Cuts and Jobs Act the cap is set to expire at the end of 2025. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits.

SALT Repeal Just Below 1 Million is Still Costly and Regressive. Enacted by the Tax. WHEREAS on December 22 2017 the Tax Cuts and Jobs Act Public Law 115-97 Act was signed into law as the largest overhaul of the federal tax code in the past thirty years and which included a 10000 limitation on deductions for state and local taxes SALT cap.

Pelosi defends SALT deduction in Dems spending bill insists it wont benefit the rich Pelosi contradicts nonpartisan analyses showing SALT repeal is boon to the rich. But dont worry Suozzi hasnt forgotten and is making his stand. Democrats are at loggerheads over a progressive Trump-era revision to the tax code.

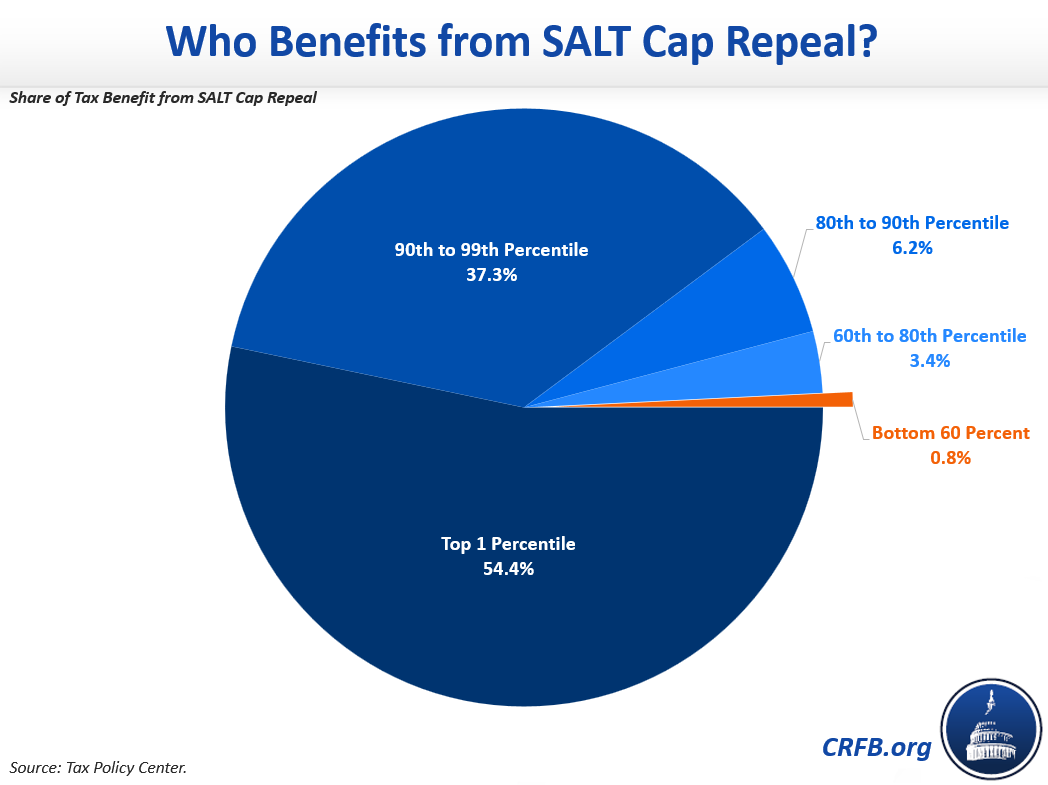

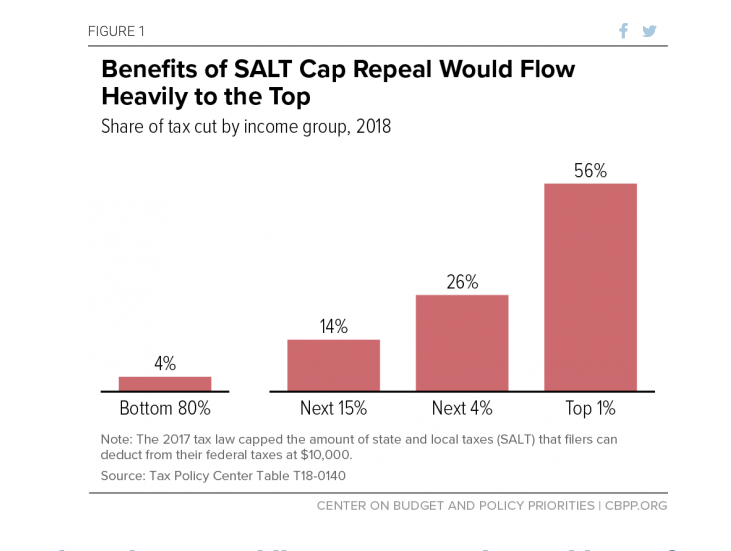

The Tax Cuts and Jobs Act of 2017 slashed taxes for the rich and corporations with 83 percent of the benefits trickling up to the top 1 percent. 54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as. Democrats are angling to repeal a Trump-era limit on state and local tax deductions as part of President Bidens signature spending plan but a new analysis shows how the bulk of the proposal.

Advocates on one side continue to push for repeal and advocates on the other side push for extension into 2026 and beyond. We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in. However it also instituted a 10000 deduction cap on state and local taxes.

A Democratic proposal aims. The SALT cap has been debated by federal policy makers since its adoption. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package.

On Trump Was Right About the SALT Cap. There is widespread recognition across the political spectrum that the vast majority of the SALT deduction benefits the wealthy and a repeal of the cap on the SALT deduction would amount to a tax break for the wealthiest Americans.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Why Repealing The State And Local Tax Deduction Is So Hard

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget